Child Tax Credit For 2024 Filing Years

Child Tax Credit For 2024 Filing Years – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . Child tax credits are likely to be expanded thanks to a $78 billion tax agreement between the Democrat-led Senate Finance Committee and the Republican-helmed House Ways and Means Committee. .

Child Tax Credit For 2024 Filing Years

Source : www.cpapracticeadvisor.com

2024 Federal EV Tax Credit Information & FAQs Plug In America

Source : pluginamerica.org

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Child Tax Credit 2023 2024: Requirements, How to Claim

Source : www.nerdwallet.com

The $7,500 EV tax credit will see big changes in 2024. What to

Source : www.npr.org

Should You File Your Tax Return? 2024 Child Tax Credit Changes

Source : www.youtube.com

Child Tax Credit 2024: Will there be a Child Tax Credit in 2024

Source : www.marca.com

Child Tax Credit 2024: Easy guide to your credit for dependents:

Source : www.usatoday.com

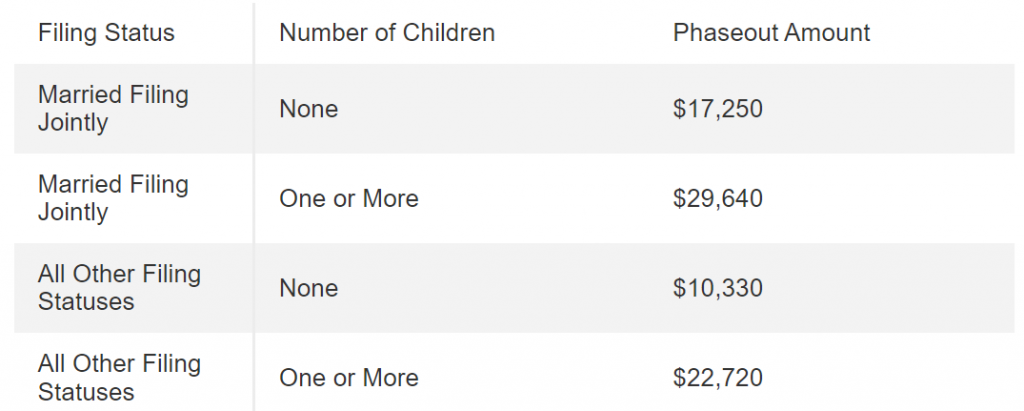

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

Child Tax Credit For 2024 Filing Years Here Are the 2024 Amounts for Three Family Tax Credits CPA : A guide to the Child Tax Credit in 2024. The child tax credit stands as a significant federal tax benefit designed to offer financial support to American taxpayers raising children. This credit allows . The claiming process for tax year 2023 involves filing the federal tax return (Form tax credit maximum will also be adjusted for inflation in 2024 and 2025. Personal FinanceNew Child Tax Credit .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)