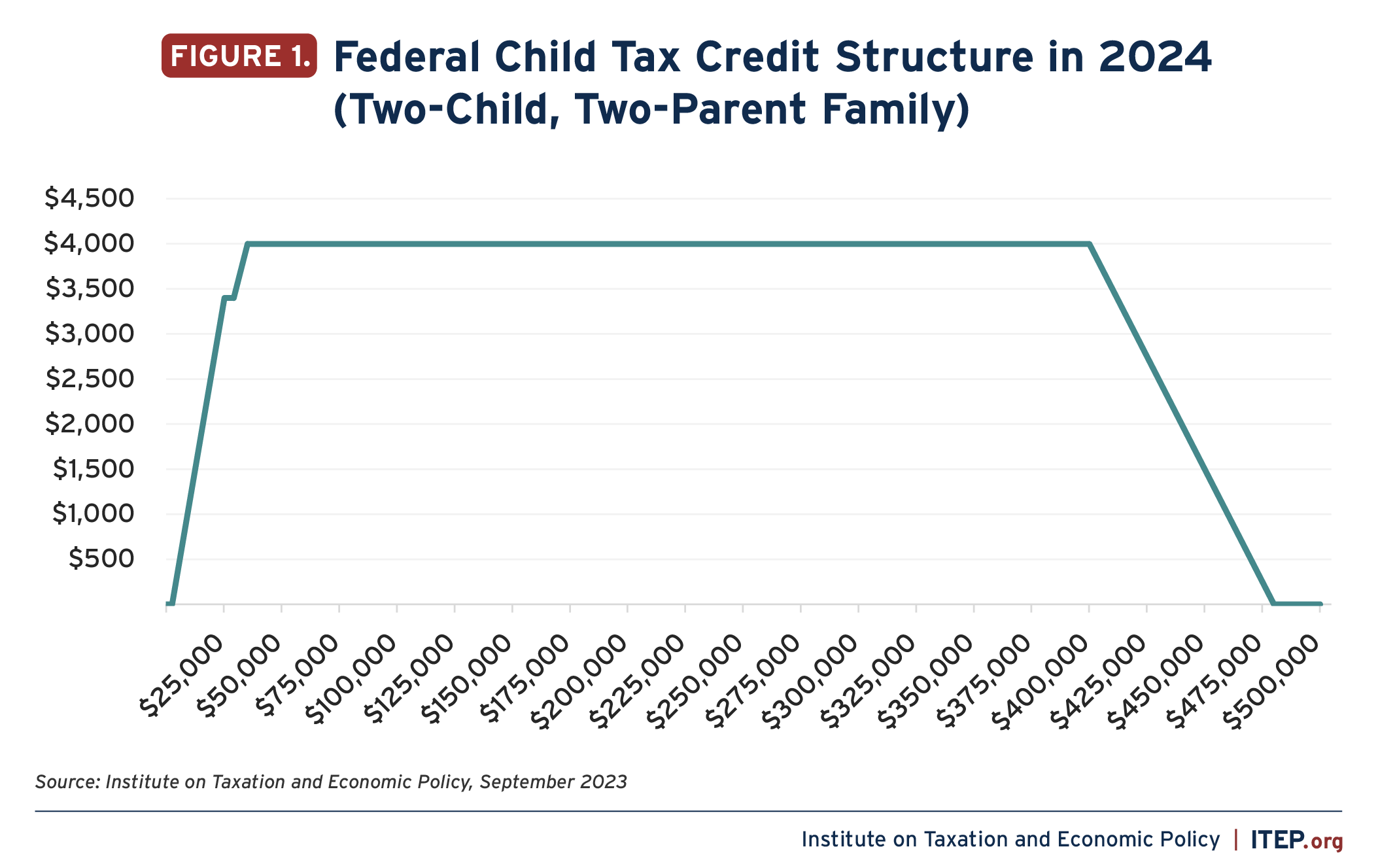

Benefits And Drawbacks Of Child Tax Credit 2024 Changes

Benefits And Drawbacks Of Child Tax Credit 2024 Changes – A new tax bill aims to increase access to the child tax credit for lower-earning families — but it’s much less generous than it was in 2021. . If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can .

Benefits And Drawbacks Of Child Tax Credit 2024 Changes

Source : www.npr.org

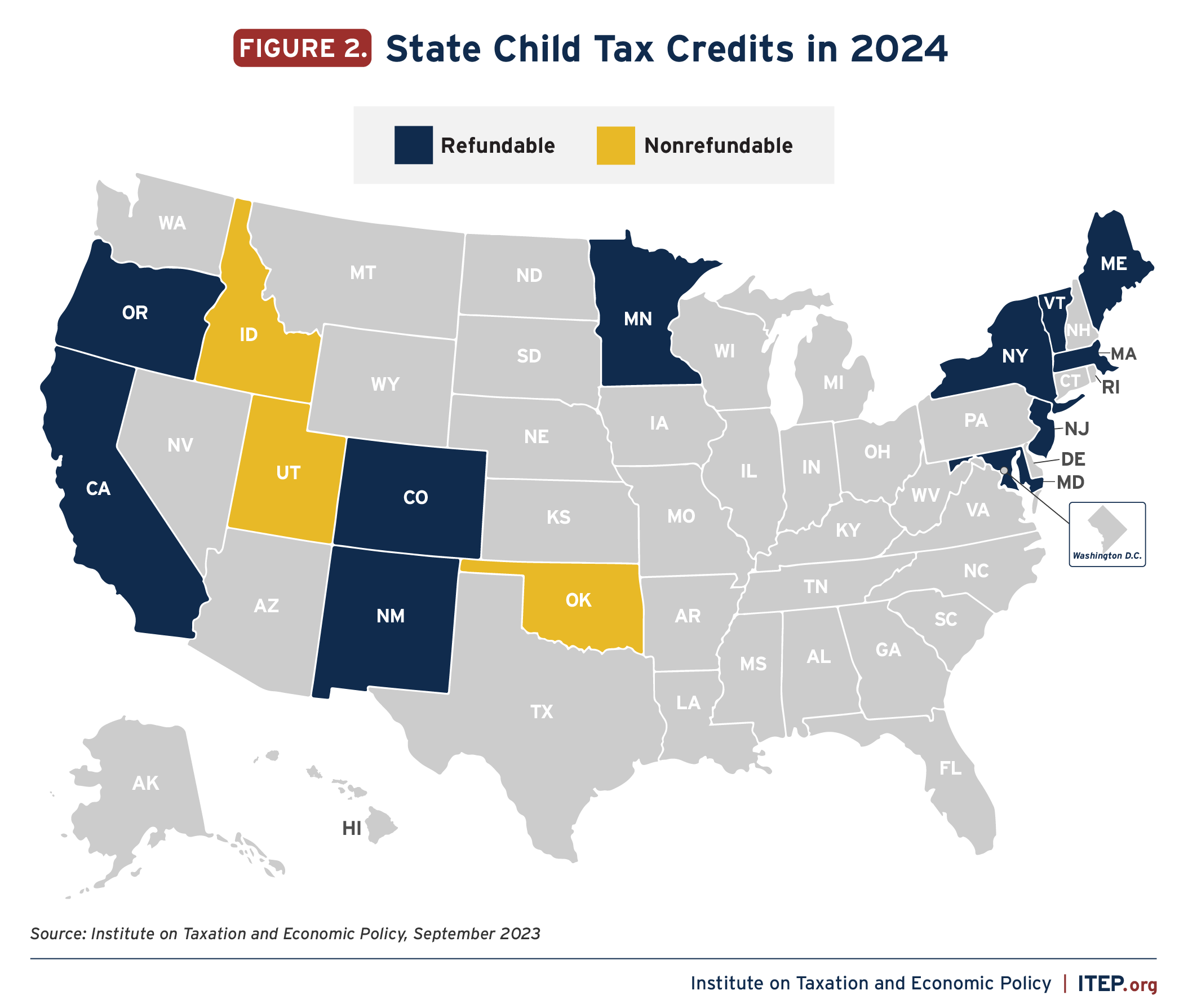

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

New Expanded Child Tax Credit Proposed: Who Would Benefit? | Money

Source : money.com

Expanding the Child Tax Credit Would Help Nearly 60 Million Kids

Source : itep.org

Tax Policy Center | Washington D.C. DC

Source : www.facebook.com

The $7,500 tax credit for electric cars will see big changes in

Source : www.opb.org

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

California State Controller’s Office | Sacramento CA

Source : www.facebook.com

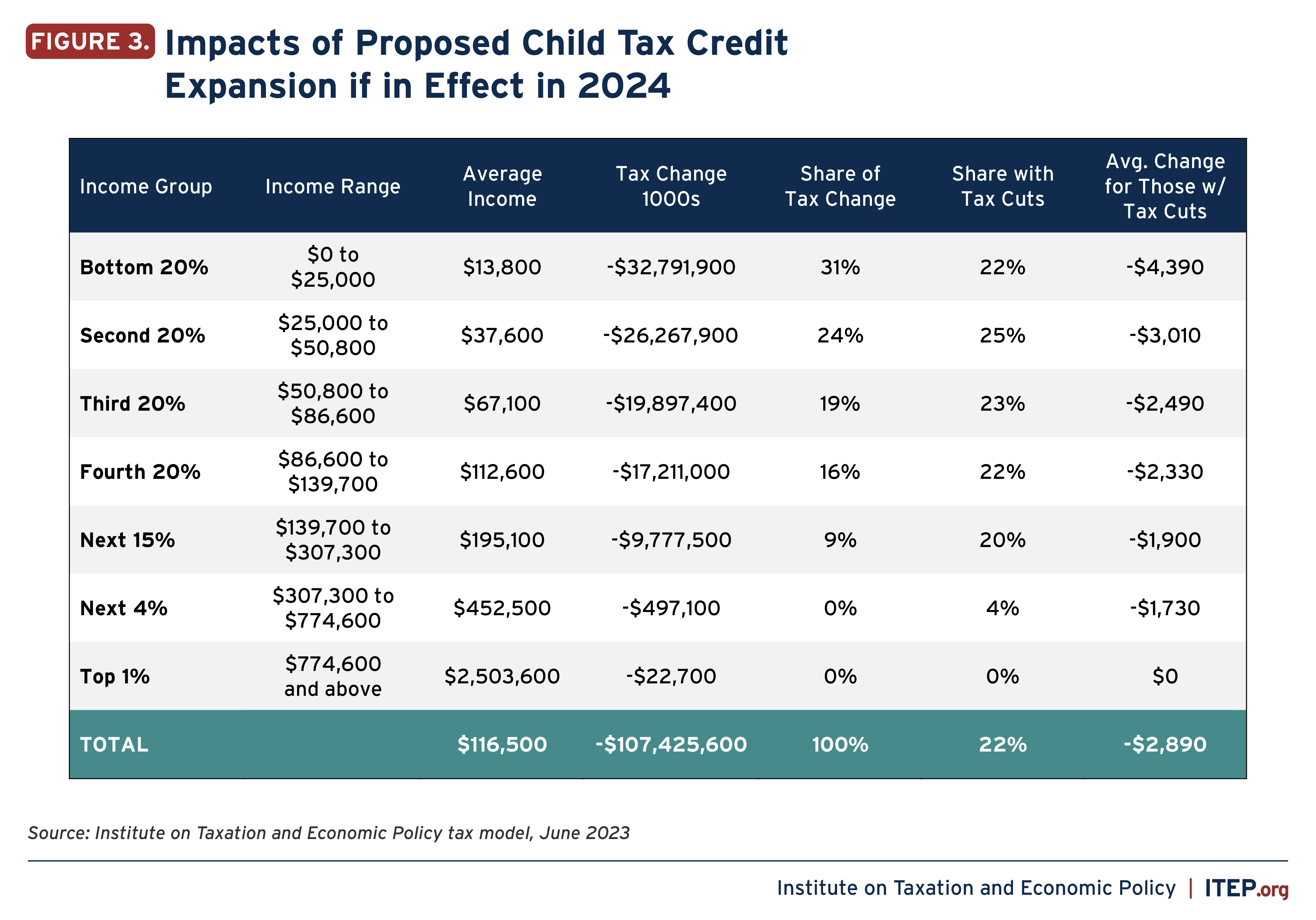

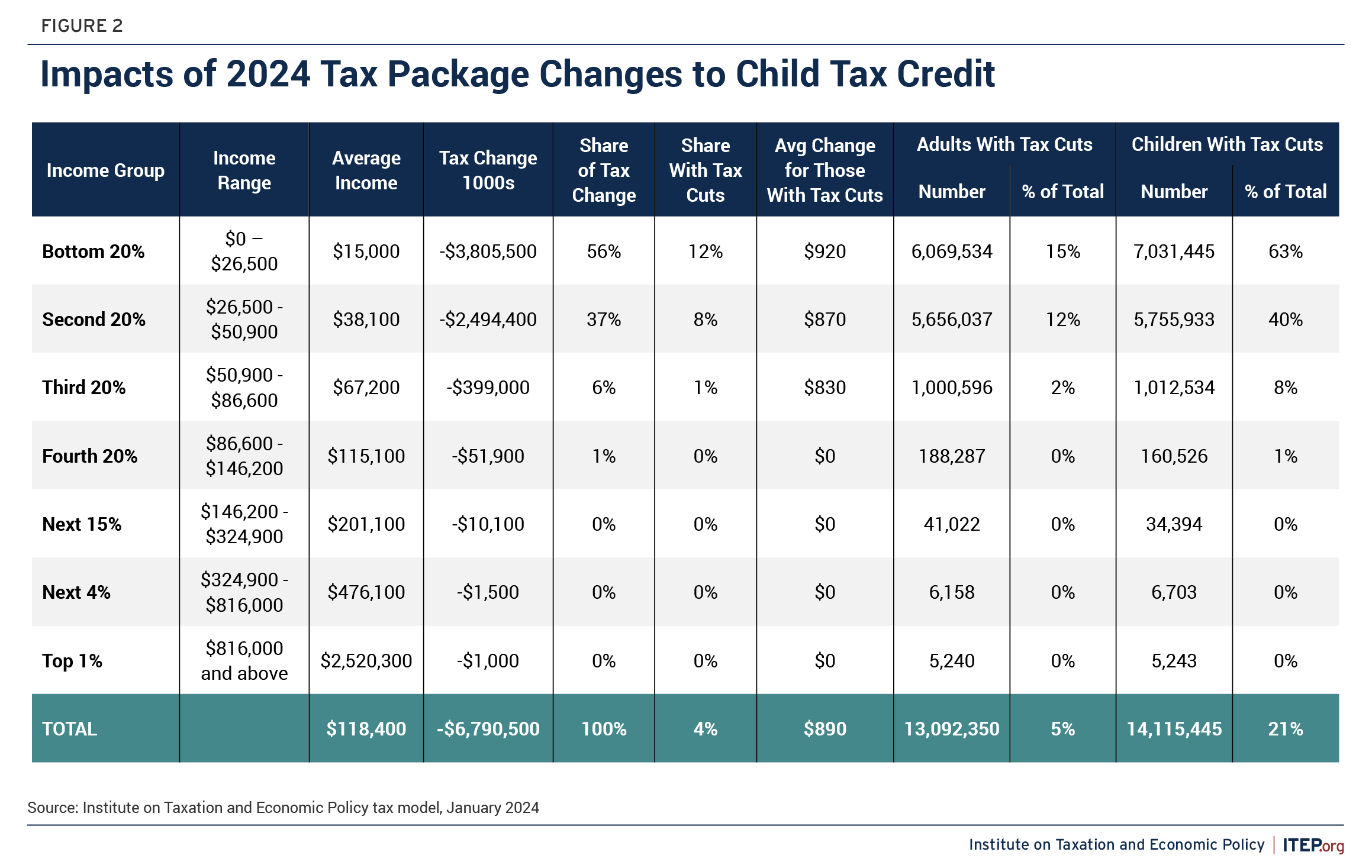

Benefits And Drawbacks Of Child Tax Credit 2024 Changes The $7,500 EV tax credit will see big changes in 2024. What to : The $78 billion bipartisan tax package includes temporary child tax credit changes that could affect millions of families filing 2023 taxes. If the legislation is enacted, eligible families could see . Millions of children could benefit from a bipartisan compromise bill on the child tax credit proposed last week, but it would fall far short of the pandemic-era expansion of the popular tax benefit. .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)