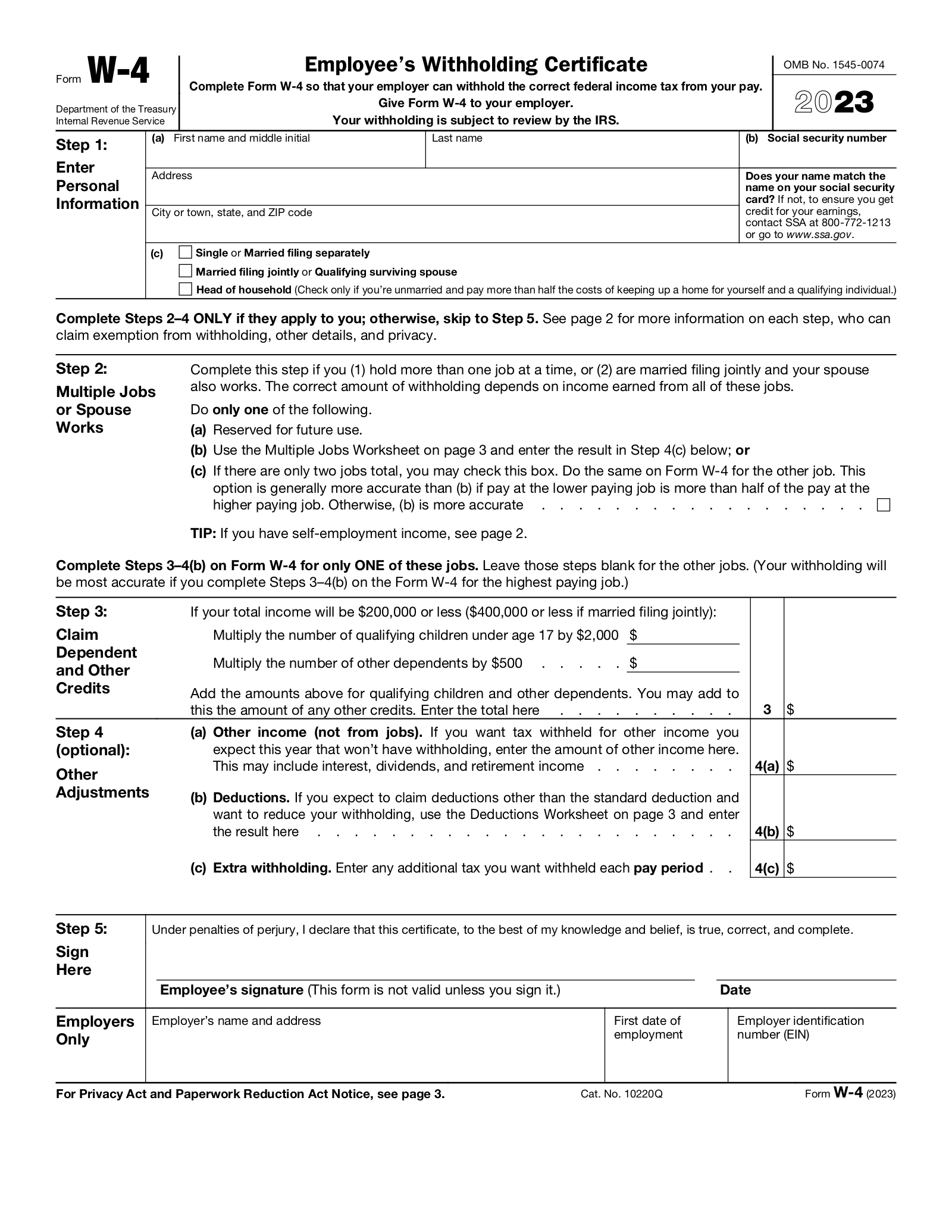

2024 W 4 Form Illinois

2024 W-4 Form Illinois – Use our free W-4 calculator to estimate how much to withhold from each paycheck and make the form work for you. Many or all of the products featured here are from our partners who compensate us. . Is Box 2(c) on the W-4 form Checked?: If Box 2(c) is NOT checked, then the federal withholding is calculated from the STANDARD threshhold tables. If it IS checked, then the federal withholding is .

2024 W-4 Form Illinois

Source : www.dochub.com

2024 Form W 4P

Source : www.irs.gov

Illinois w4: Fill out & sign online | DocHub

Source : www.dochub.com

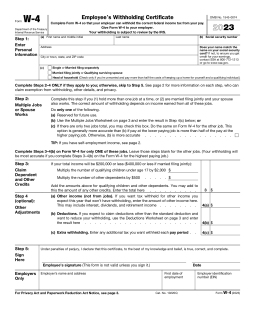

Free IRS Form W4 (2024) PDF – eForms

Source : eforms.com

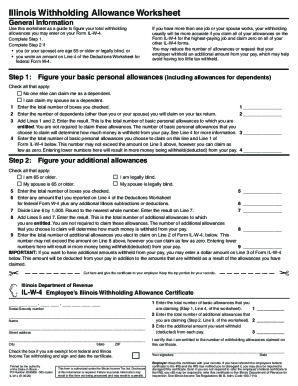

IL IL W 4 2020 2024 Fill out Tax Template Online

Source : www.uslegalforms.com

State W 4 Form | Detailed Withholding Forms by State Chart (2024)

Source : www.patriotsoftware.com

How to Fill Out the W 4 Form (2024) | SmartAsset

Source : smartasset.com

State W 4 Form | Detailed Withholding Forms by State Chart (2024)

Source : www.patriotsoftware.com

Free IRS Form W4 (2024) PDF – eForms

Source : eforms.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

2024 W-4 Form Illinois Illinois w4: Fill out & sign online | DocHub: Federal Form W-4 is used to help employers collect information needed to take out the proper amount of federal income taxes from employees’ paychecks. What the employee enters on the form will affect . More than 7,000 Illinois workers are owed back wages being held by the U.S. Department of Labor’s Wage and Hour Division. The federal agency reports it has more than $5 million in unclaimed wages that .